Parenting And Parenting Styles – Nobody said parenting was easy, but are you wondering what your parenting style is like? This can help us better understand you, your children, and your relationship with them.

Parenting, dammit! It can be a word that has many meanings. It would be nice if there were complete guidance and guidelines that could be applied to all parents and all children, but there are none yet. No parent is perfect, and there is no right way to parent. Take the example of a family where the children grow up in the same way, but there are millions of outcomes and alternatives for each child.

Parenting And Parenting Styles

Many couples disagree about how best to raise their children, and are often surprised by how strongly they feel on the issue. Every child is completely different, with a different personality, different likes and dislikes, and therefore different from their parents. All of this produces a variety of opinions and different results. There is no “right way” or “one way street.” But as parents, we just want to do good, communicate, and learn.

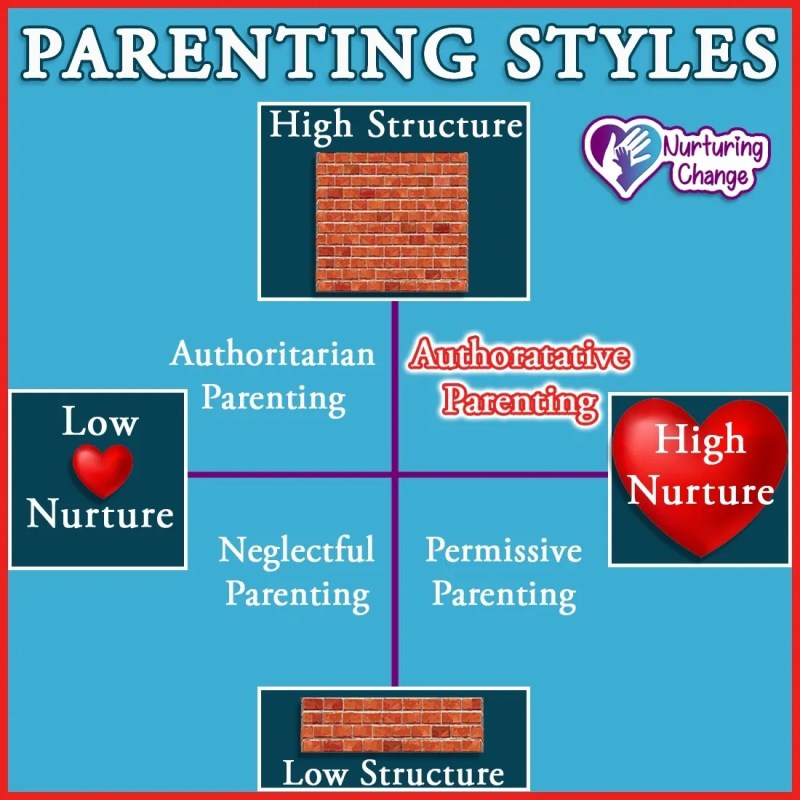

The 4 Parenting Styles

Parenting styles are important and useful to understand for many reasons. An important aspect is that your style is likely different from your partner’s style. Understanding each other and related forces makes alignment easier. Ultimately, we want to raise great kids, and that’s a goal we as parents should strive for, if knowing the most effective methods helps.

Currently, there are four common parenting styles. In 1960, developmental psychologist Diana Baumrind formulated three key practices based on her research and knowledge of how parents raise their children. Maccoby and Martin also helped refine the model in the 1980s.

Baumrind notes that preschoolers exhibit very different types of behavior. Each type of behavior is highly correlated with a particular type of parenting. Although Diana Baumrind first developed an understanding of parenting styles, Maccoby and Martin expanded the original three parenting models into four parenting models in 1983.

. They expanded Baumrind’s permissive parenting style into two other types: permissive parenting, known as permissive parenting, and neglectful parenting, known as indifferent parenting.

Parenting Styles In Psychology: Which Is The Best?

This style is recommended by psychologists and is something every parent aspires to. This is a “parent knows best” approach that emphasizes obedience while showing affection and reassurance. Authoritative parents set high standards, emphasize the need to be polite and responsive, and respect their children as independent, rational beings. Authoritative parents expect maturity and cooperation and provide a lot of emotional support to their children.

This approach to raising children combines warmth, sensitivity, setting limits and boundaries, but still believes in discipline. Parents use open, positive reinforcement and reasoning to guide their children. They avoid using threats and harsh punishments.

Children raised by authoritative parents tend to be more independent, independent, socially accepted, academically successful, and highly educated. They feel whole, respected, and acknowledged. They are less likely to report depression and anxiety, and less likely to engage in antisocial behavior such as juvenile delinquency or drug use. Research has shown that this type of positive discipline produces resilient, confident, respectful children, good leadership qualities, and happy children. Research shows that having at least one authoritative parent can make a big difference.

Authoritarian parenting is considered a parenting style that is too strict. They demand absolute obedience and enforce good behavior through psychological control, including threats, shame, and other punishments. This is a parenting style that involves less parental warmth and responsiveness and more obedience and military rule.

What Is My Parenting Style Quiz

This style is detrimental to children’s health, especially in stressful environments. There is also evidence that authoritarianism can be detrimental and exacerbate behavioral problems in children. But it’s not all bad. They tend to be well-behaved, understand safety, and are often goal-oriented. These professionals often have the weakness of being socially and emotionally withdrawn. They often become rebellious, and when they don’t get results, they become more anxious and harsh towards themselves.

Permissive parents rarely set rules and boundaries and are reluctant to enforce them. These generous parents are loving and forgiving, but they hate rejecting or disappointing their children. These parents are a lot of fun to be around and usually allow unrestricted access to all things fun.

Because permissive parents give their children more freedom, they tend to be more confident, creative, and adventurous. But research shows that children of permissive parents tend to have the worst outcomes. They tend to have difficulty following rules, have little or no self-control, and tend to be selfish. They tend to engage in riskier and more rebellious behavior. Several studies show that children raised by permissive parents are more susceptible to anxiety and depression because they are encouraged to keep their problems to themselves. Children raised by permissive parents often experience more problems in interpersonal relationships and social interactions.

Negligent parents don’t set firm limits or high standards. They tend to be indifferent to the child’s needs and are not involved in the child’s life. In essence, negligent parents abandon their children, who are left to raise them on their own. They don’t set rules or expectations, but they also don’t provide guidance when needed. In extreme cases, this parental neglect can be detrimental to the child’s well-being. These uninvolved parents may suffer from mental health problems such as depression, physical abuse, or neglect of their children as children.

Pdf] Parenting Styles And Self Esteem Of Adolescents: A Systematic Review

Children with indifferent and indifferent parents tend to be more impulsive and have difficulty regulating their emotions, but they also tend to learn to be independent and meet their basic needs from a young age. Research has shown that these children face more behavioral and addiction problems. Another serious disadvantage of indifferent parenting is that these children fail to develop an emotional connection with their indifferent parents. A lack of love and attention at a young age can, and often does, lead to low self-esteem or emotional neediness in other relationships. If parents do not intervene, their children’s social skills are often affected.

You should evaluate your parenting style, take a quiz, find out where you and your partner fit, and decide whether you need to make changes to raise your children better than you. Ultimately, raising great children should always be our hope and desire. What if it could be better?

Decades of research consistently links authoritative parenting to better child outcomes. Authoritative parenting is considered the best parenting style by psychologists, but it is you and your children who are important. If you find it difficult to raise children alone or with your partner, seek professional advice. A counselor can help your family identify what changes need to be made and point them in the right direction.

Of course, there are many different subtypes of parenting styles, but they all fall into the four main categories mentioned above. Here are some other parenting patterns that mothers and fathers need to know:

Parenting Styles Word Search

Parents in free-range environments allow their children to be independent with little or no supervision in public. During this time, parents who engaged in this practice were considered negligent, and many thought they were endangering their children due to lack of supervision. In fact, some individuals have run into trouble with the law after giving their children freedom in public. But recently (and after much debate), states like Utah have passed laws supporting in-person care. Proponents say it can instill extraordinary qualities such as independence and resilience.

If you are an overprotective parent and feel the need to control most aspects of your child’s life, you may fall under the criteria of a helicopter parent. Helicopter parents are always involved in their children’s lives and obsessed with success or failure (specifically, they want to protect their children from failure). The risk assessment tendencies in helicopter parenting are often driven by fear and anxiety, which can hinder a child’s ability to learn important life skills, self-confidence, and independence.

Snowplow parents (also known as lawnmower or bulldozer parents) are willing to easily give up anything, no matter how small, to meet their children’s wants and needs. They basically “tear down” everything that gets in their child’s way. Parents who mow the lawn often have good intentions and don’t want their children to suffer. However, these habits do not provide a foundation for long-term happiness and can reinforce children’s anxiety about failure.

One of the most balanced parenting methods, the Lighthouse Approach was created by pediatrician and author Dr. Kenneth Ginsburg. He says this in his book:

Types Of Parenting Styles That Cause Anxiety In Kids

“We have to be a beacon for our children. A steady beacon of light to compete with on the coastline. Role model. We have to look at the rocks and be careful not to hit them. We need to look into the water and prepare them to face the waves, and have confidence that they can learn to do it.” It’s the perfect balance between loving, protecting, communicating and nurturing our children. That means finding.

Book an appointment with one of Connectable Life’s amazing experts: https:///